Concentration Nation

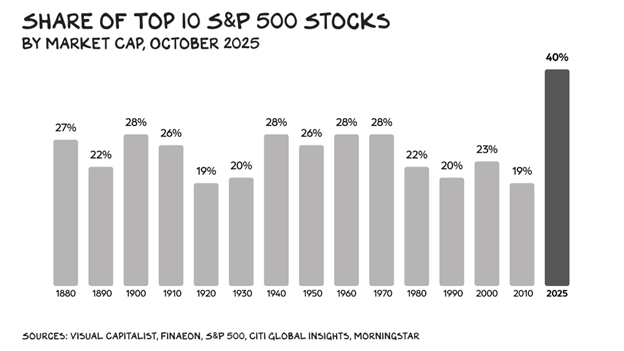

Over the past few years, a small group of large-cap technology companies has carried the stock market to new highs. The top ten stocks in the S&P 500, companies like Apple, Tesla, and Nvidia, now account for about 40 percent of the index’s total weight, the most concentrated level ever.

For investors who have been overweight mega-cap technology, concentration has been rewarding. Still, history reminds us that leadership in the stock market is rarely permanent. The same dynamic that lifts a portfolio on the way up can amplify declines when sentiment shifts. A portfolio that is highly correlated, where many holdings move in the same direction, may perform well in strong markets but becomes more vulnerable to sharp losses when conditions change.

At First Fiduciary, we’ve participated in the gains while keeping balance at the forefront. To us, diversification is more than a cliché; it is one of the most reliable tools investors have to protect long-term capital. A well-diversified portfolio carefully spreads exposure across different industries, geographies, and business models, reducing dependence on any single theme or sector to drive results.

While it is impossible to predict when today’s market leaders might cool off, we do know that trees do not grow to the sky. Eventually, valuations and fundamentals realign, and leadership broadens out. Owning high-quality businesses across sectors ensures participation in future growth areas while helping cushion the impact of inevitable downturns.

In short, downside protection is always top of mind for us. We build portfolios designed to endure multiple market environments rather than chase what happens to be working today. With concentration at historic levels, we remain focused on balance. In our view, true investment success isn’t just about how much you capture in bull markets but also how well you preserve wealth when the cycle inevitably turns.

Articles We Enjoyed:

Men Need Twice As Much Exercise

A large study shows that women cut their heart-disease risk by 30% with 250 minutes of weekly exercise, while men needed 530 minutes for the same effect.

Animals Respond to Human Noise

As human noise fills the planet, animals adapt in surprising ways: some mimic car alarms to attract mates, while others flee entirely.

AC is Cheap, but AC Repair is Not

A sharp essay on why products keep getting cheaper even as the skilled labor to fix them keeps getting pricier.

Is the Internet Killing Culture

In a world where attention spans are shrinking and everyone’s a creator, one writer wonders what’s been lost in the shift from devouring books to scrolling videos.

The New York Times highlights 18 great books about road trips.

Mississippi Leading America's Reading Revolution

Once a national punchline for poor schools, Mississippi has quietly turned the tide against illiteracy, using phonics and intensive teacher training to lift student reading scores.

Notable Reads

Sweet Taste of Liberty

by W. Caleb McDaniel

The winner of the 2020 Pulitzer Prize in History, Sweet Taste of Liberty tells the story of Henrietta Wood, a woman born into slavery around 1818 (birth records and most other records involving enslaved people were extremely limited, inaccurate or destroyed). Wood was legally freed in 1848 and settled in Cincinnati. In 1853, a crooked Kentucky sheriff colluded with Wood’s employer, kidnapped her and sold her back into slavery. The Emancipation Proclamation signed in 1863 and the end of the Civil War in 1865 did not mean the end of slavery throughout the US. As the book details, many slaveowners were reluctant to abandon the primary source of their income and confederate state government cooperation was inconsistent at best. By 1869, however, Wood returned to Cincinnati after obtaining her freedom a second time, accompanied by her son. Wood sued the man who abducted her and sold her back into slavery. After eight years of litigation against all odds, Wood was victorious and was awarded the sum of $2,500, the largest amount of restitution for slavery ever ordered by an American court. In addition to the amazing story of Wood’s fight for justice, the book provides an eye-opening account of the lives of the enslaved and the slow crawl towards true freedom after the end of the Civil War. Highly recommended to help fill in the blanks which were never taught in history class. - BH

Mosquito Coast

by Paul Theroux

A father, disillusioned with American materialism, uproots his family for a life in the Honduran wilderness. Despite his skills as an outdoorsman and amateur inventor, the task is more than he can handle, triggering his fall into obsession and madness. Told through the eyes of his oldest son, the story captures both the awe and unease of living under his father’s grandiose vision. While Theroux vividly depicts the jungle and the father’s dogged pursuit of self-reliance, the narrative falters with heavy-handed moments and uneven pacing. Its critique of consumerism is sharp but often sacrifices emotional nuance, leaving supporting characters underdeveloped. The Mosquito Coast is gripping but ultimately misses its full potential. - AG

They Shoot Horses, Don't They

by Horace McCoy

In Depression-era Los Angeles, desperate souls enter a grueling dance marathon, hoping for fame or just a hot meal, only to be crushed under the weight of exhaustion and despair. McCoy’s clipped, brutal prose captures the physical and psychological toll of the contest, turning a cheap spectacle into a metaphor for hopelessness. The novel’s framing device, a murder trial set after the events of the marathon, adds to the grim tragedy. The story’s bleakness is relentless and won’t be soon forgotten. – AG

More Than A Trusted Investment Advisor

Recently, we helped a client open an investment account for his high school–aged son, giving him an early start on learning how to invest and build long-term wealth. We met with the son to discuss investment styles, strategies, risks and philosophy. By taking ownership of real investments now, he’s gaining valuable experience and a head start toward financial independence.

If you’re looking for ways to teach investing and financial responsibility to the next generation, we’d be happy to share ideas that fit your family.

The data contained within this newsletter is for informational purposes only. The information contained herein should not be considered investment, tax or legal advice.

This newsletter contains links to external third party websites that are not affiliated with First Fiduciary Investment Counsel. FFIC does not control or direct the content of the information contained on these websites. Information contained on the third-party website is relevant on the date the newsletter was published but may be changed or revised by the third parties without the knowledge of and/or notice to FFIC.

Statistics and other information have been compiled from various sources. First Fiduciary Investment Counsel believes the facts and information to be accurate and credible but makes no guarantee to the complete accuracy of this information.

Past performance does not guarantee future results. The mention of securities or types of securities in this newsletter should not be considered as an offer to sell or a solicitation to purchase or sell any securities mentioned. Neither First Fiduciary nor the authors hold positions in any of the stocks mentioned unless otherwise stated.

First Fiduciary Investment Counsel, Inc. is a registered investment adviser with the Securities and Exchange Commission. A more detailed description of the company, its management and practices is contained in its firm brochure document, Form ADV, Part 2. A copy of this form may be received by contacting the company at: 6100 Oak Tree Blvd., Suite 185, Cleveland, OH 44131; Phone: 216.643.9100; Email: ffic@firstfiduciary.com.